Next Frontier in Bitcoin Access: PMN

- Administrator Pan

- Jul 20, 2025

- 3 min read

Updated: Aug 1, 2025

From ‘Bitcoin Treasury Stocks’ to Tokenized Mining Notes: How PMN Opens the Door for Institutional Bitcoin Exposure

“When institutions can’t buy Bitcoin directly, structured and compliant products become the gateway.”— Inspired by Lyn Alden, The Rise of Bitcoin Stocks and Bonds

Why Did MicroStrategy Outperform Bitcoin?

You may have noticed: Since 2020, some Bitcoin-related stocks have massively outperformed Bitcoin itself. MicroStrategy (MSTR), the quintessential “Bitcoin treasury stock,” gained over 2,850%, while BTC rose around 800% during the same period.

Why?

Because institutional capital, especially large funds and pensions, can’t always buy Bitcoin directly.

Restricted by mandates, custodial requirements, and regulatory constraints, these institutions are turning to compliant, indirect vehicles. As Lyn Alden explains in her widely shared essay, this demand has fueled the rise of Bitcoin treasury stocks and Bitcoin-linked bonds, which offer exposure through structured, regulated formats.

Enter Pivotal Mining Note (PMN): Bitcoin Infrastructure, Structured for Institutions

PMN is a security token issued by Pivotal Trend Service Co., Ltd. that offers access to real Bitcoin mining income—without needing to operate mining machines or directly hold BTC.

Key features:

SEC Regulation D & S compliant — available to accredited U.S. investors and non-U.S. persons;

36-month locked Bitcoin mining contract per unit;

Investors receive a single BTC payout after the term, based on actual mining output;

BTC is held and secured via Coinbase Custody or equivalent regulated providers;

Designed for institutional adoption, with transparency and regulatory clarity.

In short, PMN like a “mining bond” — a new asset class that bridges digital infrastructure and structured capital.

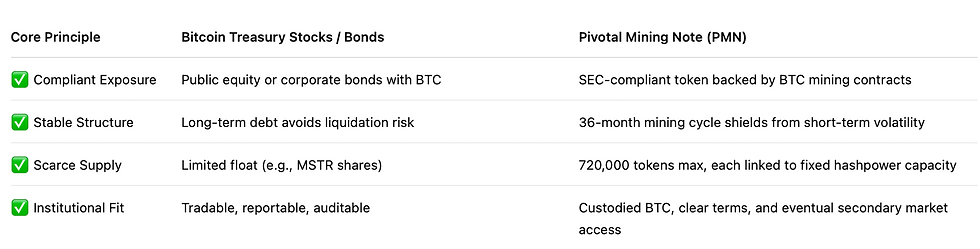

How PMN Reflects the Logic of Bitcoin Treasury Products

Just as treasury stocks brought Bitcoin into institutional portfolios through equity, PMN introduces Bitcoin mining as a compliant, securitized investment product.

Why PMN Is a Scarce and Unique Asset

Regulatory Rarity: Few products globally combine compliant issuance with physical Bitcoin mining.

Fixed Supply: The first issuance is capped, and each unit is backed by real-world infrastructure.

Economic Advantage: Investors lock in BTC production at a significantly lower cost than spot BTC purchases.

Liquidity Potential: PMNs are structured for secondary trading via regulated exchanges such as INX.

This makes PMN one of the few vehicles that combine productive BTC exposure, compliance, and structural scarcity—a potent trio in today’s investment environment.

Strategy Backed by Data

Back-tested using actual market data from July 2022 to July 2025, the PMN strategy showed:

47.9% more BTC accumulation than dollar-cost averaging (DCA);

138.7 percentage point higher return over the 3-year horizon;

Average mining cost was 51.5% lower than spot market purchase price.

This means PMN isn’t just a narrative win—it’s a data-backed optimization strategy.

Who Is PMN Designed For?

High-net-worth individuals & family offices seeking long-term BTC accumulation;

Crypto hedge funds & alternative asset managers looking for yield-backed instruments;

Institutional allocators needing regulatory-compliant exposure to Bitcoin infrastructure;

Bitcoin believers who want low-cost, secure accumulation—without managing hardware.

A New Chapter for Bitcoin Capital Markets

Bitcoin is maturing. No longer just a speculative asset, it’s becoming an institutional asset. As Lyn Alden writes, the rise of treasury stocks and bonds represents a structural shift—not a trend.

PMN is part of that shift.

It brings Bitcoin mining into the reach of structured capital markets, with the same standards of disclosure, custody, and return modeling that institutions expect. And it does so without sacrificing the core ethos of Bitcoin: ownership, production, and decentralization.

Final Thoughts: Building a Bridge Between Institutions and Infrastructure

PMN represents a new way of thinking about capital allocation in the Bitcoin economy.

It’s not an ETF.

It’s not a synthetic derivative.

It’s Bitcoin infrastructure, tokenized.

And like the best financial innovations, it solves real problems—providing a compliant, transparent, and productive path to Bitcoin accumulation for those who can’t touch spot BTC directly.

If you believe Bitcoin is here to stay, PMN is how you help institutions participate in building it.

📎 Want to learn more?

Visit pivotal-ts.com or join our official Telegram at t.me/PivotalSTO to discover how you can participate in the future of compliant Bitcoin mining investment.

Comments